Accounting Software for Small Businesses

Xero vastly outperforms QuickBooks in its fixed asset management tools. With QuickBooks, you can record the purchase of a fixed asset, but with Xero, you can track fixed assets, calculate and track their depreciation, and much more. Xero also offers stronger tools for tracking project profitability, giving you access to real-time reports. Additionally, Xero is a better choice for international businesses needing multicurrency support. At Fundera, Randa specializes in reviewing small business products, software, and services. Not only do all four of the QuickBooks Online plans include capabilities for managing sales tax, but the classification of investments they each also offer tools to maximize tax deductions as well as manage 1099 payments.

- NerdWallet independently reviews accounting software products before determining our top picks.

- Both of these accounting applications have solid bank feed systems.

- QuickBooks goes beyond accounting with 750+ integrated apps, streamlining everything from payroll to customer relationships.

- With the Xero Expenses feature set, you can track, assign, and manage your business’s expense claims.

- Xero’s Early plan gives you 5 bills and 20 invoices, but it only offers unlimited invoices and bills starting in its second product tier.

The main differences between Xero vs QuickBooks lie in features and pricing. Xero is more affordable than QuickBooks Online, always includes unlimited users, and offers inventory management and fixed asset accounting in all its plans. QuickBooks Online and Xero are well-known cloud-based business accounting software solutions that are a favorite of growing companies due to their affordable pricing and scalability. These systems provide accounting features such as invoicing, accounts payable and receivable, and inventory management to help your business stay organized and profitable.

Popular features

Instead, the Xero vs. QuickBooks Online winner ultimately depends on your business—what features you need, what your budget looks like, and what capabilities are most important to you. In terms of report layouts in Xero, the layout on the monthly reports goes from left to right—most recent month to oldest. When accountants transfer monthly reports into a spreadsheet to analyze and project, they’ll need to reverse the order of the columns—which isn’t an easy task. In order to get a monthly profit and loss statement or balance sheet in QuickBooks Online, you can simply run the report for the date range. Then, in the options section in the top region, you can choose to show the columns by month.

While Xero is easier to set up, QuickBooks has a more intuitive and customizable dashboard and has time-saving features. For instance, QuickBooks Online allows you to add an inventory item from the invoicing screen, something you can’t do with Xero. QuickBooks Online outclasses Xero in cost of sales to revenue ratio this category as it offers more useful features that aid in setting up the software. Xero took a hit for its lack of assisted onboarding support and new company wizard, but it does offer the ability to import beginning balances—a feature that QuickBooks Online lacks. They’ll help you reconcile your bank and credit card statements and prepare monthly reports.

Automated features to save you time

Total cost per year is calculated by adding all the features that require additional fees. Discover seamless app integrations for efficient accounting with Xero’s comprehensive accounting software. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always 5 steps for process costing method play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe.

Can you use Xero to track inventory?

This cloud-based solution also supports cash-basis and accrual accounting methods and uses double-entry accounting. It has solid mobile apps, and it has a large number of integrations, although it falls a bit short of Xero. Both offer great accounting features and integrations, but which one is better for small businesses? While it’s not part of our case study, we evaluated Xero vs QuickBooks Online in terms of assisted bookkeeping.

With more than 3 million users worldwide, Xero is popular but not as ubiquitous as QuickBooks Online. Both Xero and QuickBooks Online have their own versions of transaction tracking tags, but QuickBooks Online is the winner in this arena. Xero lets users create two active tracking categories, while QuickBooks Online allows users to create 40 in the Simple Start, Essentials and Plus plans. QuickBooks Online’s Advanced plan allows for unlimited tag groups. The more categories you create, the more reports you can run to get a better idea of how your business functions and where there’s room to grow. All plans include 24/7 live chat support; phone support is available 5 a.m.

How to do construction accounting: Your comprehensive guide Sage Advice United Kingdom

It allows you to estimate labor, material, and overhead cost, as well as determine how much you should charge for the project. Union rates, travel pay, and taxes can also impact how much you’ll need to pay your workers. Construction companies usually need to pay their workers what’s known as a prevailing wage. Project costs vary according to the weather and season in which work is due to take place, as do the cost of materials and strain on workers and equipment.

Creating Financial Statements

- As long as they’ve estimated the unit pricing correctly, the contractor may increase their revenue in this case.

- The first step towards taking control of your finances is to understand your project costing each and every time.

- This is not always easy, as contractors often start making changes before they are officially approved and priced.

- Contractors can guide project managers and supervisors to monitor costs and production properly.

- If you don’t have a highly accurate and efficient construction bookkeeping system, the rest of your business will suffer.

- By implementing strong construction bookkeeping services, contractors can gain clear insight into their financial position, make informed decisions, and avoid common pitfalls that may hinder business growth.

- Time-and-material billing bases the contract price on a per-hour labor rate plus the actual cost of materials used.

Understanding your budget and why it’s changed is critical to pinpointing your true job costs. For instance, all of the income of the partnership needs to be reported as it was distributed to the partners. As a result, each partner shares in the losses and profits of the joint partnership. The act of withholding payment is called contract retainage and is part of a contract signed by the contractor and customer before the project’s implementation. Equipped with these bank accounts, you can significantly increase the performance of your construction business.

Relies On Long-Term Contracts

- In fact, while many U.S. small businesses prefer cash accounting for its simplicity and flexibility, only some contractors qualify.

- Even better is to back up your records onto a cloud service, so they’re accessible from anywhere.

- One common construction billing format is known as AIA progress billing, named after the American Institute of Architects, which produces its official forms.

- Labor costs are challending to track when mobile workers are used in various projects.

- As the name suggests, revenue and expenses aren’t recognized till the project is completed and all other obligations are met.

- As there must be something to it, let’s examine each principle closely — and then get into the 3 foundational pillars of construction accounting.

Common scenarios for change orders include the owner requesting adjustments like moving a wall, adding a window, or changing the flooring material. These are called ‘additive change orders’ and typically increase the contract price. This is why construction companies find it difficult to match the https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ efficiency of organizations that make the same products repeatedly in a single location. You can make real-time decisions while projects are ongoing, and you can create long-term plans for growth—as well as mobilise your business to make that happen.

Construction accounting 101: An expert guide for contractors

Properly managing and allocating G&A costs ensures that they do not disproportionately affect the profitability of individual projects. Cash basis accounting records income and expenses as soon as cash is received or paid. While simple to implement, this method may not provide an accurate picture of a project’s financial performance, particularly for long-term projects with multiple payment milestones. By the end of this article, you’ll have a deeper understanding of how to effectively manage the financial aspects of construction projects, from initial contract setup to final reporting.

Conclusion: Success in construction depends on detailed reports and practical software

Construction payroll deals with complexities that other industries don’t normally have to worry about, like prevailing wage, union payroll, and multi-state-multi-city payroll requirements. This reaffirms how important it is to account for all costs in a project regardless of The Significance of Construction Bookkeeping for Streamlining Projects whether the project makes or even loses money. To address this problem, some construction contracts include fluctuation provisions. Furthermore, construction firms must comply with local wage scales and regulations at each site. This might involve sourcing materials and machinery from nearby vendors to optimize efficiency and meet local requirements.

Xero Review 2024: Features, Pricing & More

Join 5 cash flow performance kpis every cfo needs to track your peers for the latest Xero and industry updates and announcements, plus lots of fun and inspiration.

Is Xero Right for You or Your Business?

Remember, you need to complete all four updates for the year to maintain your Advisor certification. Business owners, freelancers and entrepreneurs often spend a large chunk of time on administration and accounting. Suited for small- and medium-sized businesses (SMBs), Xero is an affordable cloud-based accounting software system that streamlines these processes with plans starting at $13 per month.

- Join over 250,000 accountants and bookkeepers using Xero in their practice.

- We carry out the check to ensure that good bookkeeping practice are in place.

- This course is designed for those who have an interest in learning how to use Xero’s Accounting software to manage the small or medium-sized business.

- In order to transfer your business to Xero from other software packages, our Xero experts are able to design a full conversion procedure to suit your business needs.

- Those who complete the course will also be awarded an official certificate that can be promoted by both the individual and the firm.

- As your practice moves from new partner to bronze, silver, gold and platinum status levels, you’ll unlock more benefits.

Xero Experts Limited provides Xero consultancy services for accountancy firms to move accounting and bookkeeping function to cloud. Our Xero consultancy has helped many other business and accounting practices to learn and migrate to Xero while improving their existing business processes. As your practice moves from new partner to bronze, silver, gold and platinum status levels, you’ll unlock more benefits.

Migration

If you’re not yet #XeroCertified but want to upskill in 2022, read on to find out more about Xero’s Advisor Certification and hear from fellow Xero partners on how it’s been useful for them. Join the Xero community of accountants and bookkeepers for more efficient collaboration, task automation and streamlined workflows. Your practice can earn points in a number of ways, including bringing clients on to Xero and using Xero products.

Xero Training for Business Owner

All courses are delivered by Xero Certified Advisors with years of accounting and book keeping experience. The Xero advisor directory helps potential clients find and connect with your practice. Small business owners can browse for an accountant or bookkeeper by location or use Xero’s matchmaking tool to find a Xero partner who works with similar businesses to theirs. When you reach bronze partner status, you’ll get a free listing that you can customize to showcase your expertise.

Popular features

An accountant and bookkeeper who is a Xero certified advisor will be properly educated on the Xero platform and able to perform Xero services efficiently and effectively. As such, they’ll be able to offer a better service to clients seeking advisors proficient in Xero, and ultimately add to the existing services provided by the firm. Those who complete the course will also be awarded an official certificate that can be promoted by both the individual and the firm. As a leading Xero Consultant and certified advisor, we provide Xero Accounting Basic training, Xero Accounting Advanced training and Xero Payroll training. We also offer bespoke training sessions on Xero cloud accounting software to suit the needs of the individual or groups.

Choose from online courses, a webinar, a live classroom or if you already know Xero well you can take our fast-track assessment. Once certified, you’ll receive an official certificate to show your clients that when you say you’re an expert in Xero – you really mean it! To maintain your certification, you’ll need to complete the four quarterly product updates each year. Gaining a Xero advisor certification will give you valuable skills that allow you to offer Xero services to clients.

Posting in Accounting

Investors, stockholders, financial-rating agencies and the Internal Revenue Service want to know the information posted in ledgers at the end of the fiscal quarter or year for various reasons. For example, investors want to see the income and liabilities you posted in the general ledger to evaluate the health of the company. Investors are not concerned with the information you recorded in your accounting journals. Good accounting practices enable businesses to track their cash flow, manage expenses, and assess the financial health of their operations. Through accurate posting, businesses can also detect discrepancies, fraud, and financial irregularities, allowing for timely corrections to prevent potential losses.

- The fourth step is to calculate the running debit and credit balance for each account.

- Posting only transfers the total balance in a subledger into the general ledger, not the individual transactions in the subledger.

- Transfer in general ledger takes place with the name of the account and amount carried forward in subledger or general journal along with entry details.

- Without proper posting, it would be challenging to prepare accurate financial statements or identify errors in the accounting system.

- Debits decrease balance sheet liability accounts, such as notes payable, and shareholders’ equity accounts, such as retained earnings.

Enter the Debits and Credits

This method is suitable for businesses with straightforward financial transactions, as it allows for a simplified approach to bookkeeping and financial management. By recording only the cash aspects of transactions, it provides a clear overview of cash inflows and outflows. This approach is particularly beneficial for businesses that primarily deal with cash, such as small retail stores, local service providers, and sole proprietors.

Improve staff payment posting accuracy with these steps

This way we can total each account and keep track of it’s balance at all time during the year. Such uniformity guarantees there are no unequal debits and credits that have been incorrectly entered during the double-entry recording process. However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes. Companies initially record their business transactions in bookkeeping accounts within the general ledger. If entries are not posted in accounting, the financial records will be incomplete and inaccurate.

Wider support available for automation

This process plays a crucial role in maintaining the accuracy of ledger accounts, as it ensures that all transactions are systematically recorded and categorized. By systematically transferring journal entries to the ledger, it becomes easier to analyze and track the movement of funds within the organization. A trial balance is a list and total of all the debit what is posting accounting and credit accounts for an entity for a given period – usually a month. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other. The trial balance is prepared after all the transactions for the period have been journalized and posted to the General Ledger.

Posting In the Closing Process

Modern computer programs allow you to correctly prepare the necessary and important reports in a short time. Within the established time frame, warehouse managers and Department managers submit these reports to the organization’s accounting department. Mentioning the date of transaction is the second step of posting a journal entry. Depending on the software used, similar modules exist to allow automated postings for payroll, inventory control, purchases order processing, sales order processing, fixed assets, job costing and bill of materials. After all accounts are posted, we can now derive the balances of each account. As shown in the ledger above, the company has $7,480 at the end of December.

Step 1: Check you can use automation

Conduct regular training sessions or webinars, and provide up-to-date manuals. Develop and enforce clear policies and standards for handling various payment posting scenarios. The final step in the posting process is to check for mathematical and data transfer errors. Accounting software packages may reduce these errors through automation, but verifying the numbers is a prudent step that prevents errors from propagating to the financial statements. Debits increase balance sheet asset accounts, such as cash and inventory, and increase income statement expense accounts, such as marketing and salary expenses. Debits decrease balance sheet liability accounts, such as notes payable, and shareholders’ equity accounts, such as retained earnings.

It is very helpful and useful in large organizations, as keeping track of the balance becomes very easy. Also, with the posing in a ledger, the arithmetic accuracy of the accounts can be verified, and the balances can be analyzed thoroughly to maintain the proper and accurate records. A well-designed automated posting system provides clear, organized financial reporting, enhancing visibility into revenue streams and facilitating more informed financial management decisions.

A bookkeeping expert will contact you during business hours to discuss your needs. A general ledger contains accounts that are broad in nature such as Cash, Accounts Receivable, Supplies, and so on. It consists of accounts within accounts (i.e., specific accounts that make up a broad account).

Posting is the transfer of journal entries to a general ledger, which usually contains a separate form for each account. Journals record transactions in chronological order, while ledgers summarize transactions by account. Accurate posting of cash transactions ensures compliance with accounting standards and regulations, enhancing transparency and reliability in financial reporting. It is an integral part of maintaining a clear and updated picture of the company’s financial standing. This organized financial information is essential for making informed business decisions and preparing financial statements.

Debits and credits of a trial balance being equal ensure there are no mathematical errors, but there could still be mistakes or errors in the accounting systems. If an income statement is prepared before an entity’s year-end or before adjusting entries (discussed in future lessons) it is called an interim income statement. The income statement needs to be prepared before the balance sheet because the net income amount is needed in order to fill-out the equity section of the balance sheet. The net income relates to the increase (or in the case of a net loss, the decrease) in owner’s equity.

What Is The LIFO Method? Definition & Examples

With each sale, the software also updates the COGS account with a debit. The real value of perpetual inventory software comes from its ability to integrate with other business systems. For instance, real-time inventory information is vital for the financial and accounting teams. Inventory can make up a large part of your stated assets, so integrating inventory management with financial systems helps ensure accurate tax and regulatory reporting. When using the perpetual inventory system, the general ledger account Inventory is constantly (or perpetually) changing. For example, when a retailer purchases merchandise, the retailer debits its Inventory account for the cost.

How Is Inventory Tracked Under a Perpetual Inventory System?

- Normally, no significant adjustments are needed at the end of the period (before financial statements are prepared) since the inventory balance is maintained to continually parallel actual counts.

- The latter is more cost-efficient, while the former takes more time and money to execute.

- In contrast, using the FIFO method, the $100 widgets are sold first, followed by the $200 widgets.

- The FIFO (First-In, First-Out) method in a perpetual inventory system has several advantages and disadvantages.

For companies under a periodic system, this means that the inventory account and COGS figures are not necessarily very fresh or accurate. Under last-in, first-out (LIFO) method, the costs are charged against revenues in reverse chronological order i.e., the last costs incurred are first costs expensed. In other words, it assumes that the merchandise sold to customers or materials issued to factory has come from the most recent purchases.

AccountingTools

Using perpetual inventory systems can help you better manage your business. Should you opt to use this type of inventory management, you should understand the main benefits and pitfalls before switching your operations. If you want to improve your logistics operations, consider implementing a perpetual inventory system.

Description of Journal Entries for Inventory Sales, Perpetual, First-in, First-out (FIFO)

Being systematic is the key to understanding how the LIFO method works. However, the way of computation may differ if you’re using the periodic inventory vs perpetual inventory system. Petersen and Knapp allegedly participated in channel stuffing, which is the process of recognizing and recording revenue in a current period that actually will be legally earned in one or more future fiscal periods. This and small business tax information other unethical short-term accounting decisions made by Petersen and Knapp led to the bankruptcy of the company they were supposed to oversee and resulted in fraud charges from the SEC. Practicing ethical short-term decision making may have prevented both scenarios. LIFO might be a good option if you operate in the U.S. and the costs of your inventory are increasing or are likely to go up in the future.

Both systems are methods for tracking and managing stock levels in businesses; however, they differ significantly in their approach. The following cost of goods sold, inventory, and gross margin were determined from the previously-stated data, particular to perpetual, LIFO costing. Most companies use the first in, first out (FIFO) method of accounting to record their sales.

What Is the Periodic Inventory System?

As inventory is stated at outdated prices, the relevance of accounting information is reduced because of possible variance with current market price of inventory. Calculate the beginning inventory as whatever stock remains from the previous period if you do not have a true beginning inventory. The COGS in a perpetual system is rolling and recalculated after each transaction, but you can use the COGS formula to calculate it for a period. A perpetual inventory system tracks goods by updating the product database when a transaction, such as a sale or a receipt, happens. Every product is assigned a tracking code, such as a barcode or RFID code, that distinguishes it, tracks its quantity, location and any other relevant details.

These include emerging businesses, ones that offer services or companies that have low sales volume and easy-to-track inventory. Companies whose staff struggle with a perpetual system, for instance those with seasonal help, would also benefit from maintaining a periodic system. As their business grows, they can always institute perpetual inventory.

As you can see, the average cost moved from $87.50 to $88.125—this is why the perpetual average method is sometimes referred to as the moving average method. The Inventory balance is $352.50 (4 books with an average cost of $88.125 each). Each approach detailed above provides a different benefit to any given manufacturer regarding financial reporting, tax obligations, or internal planning.

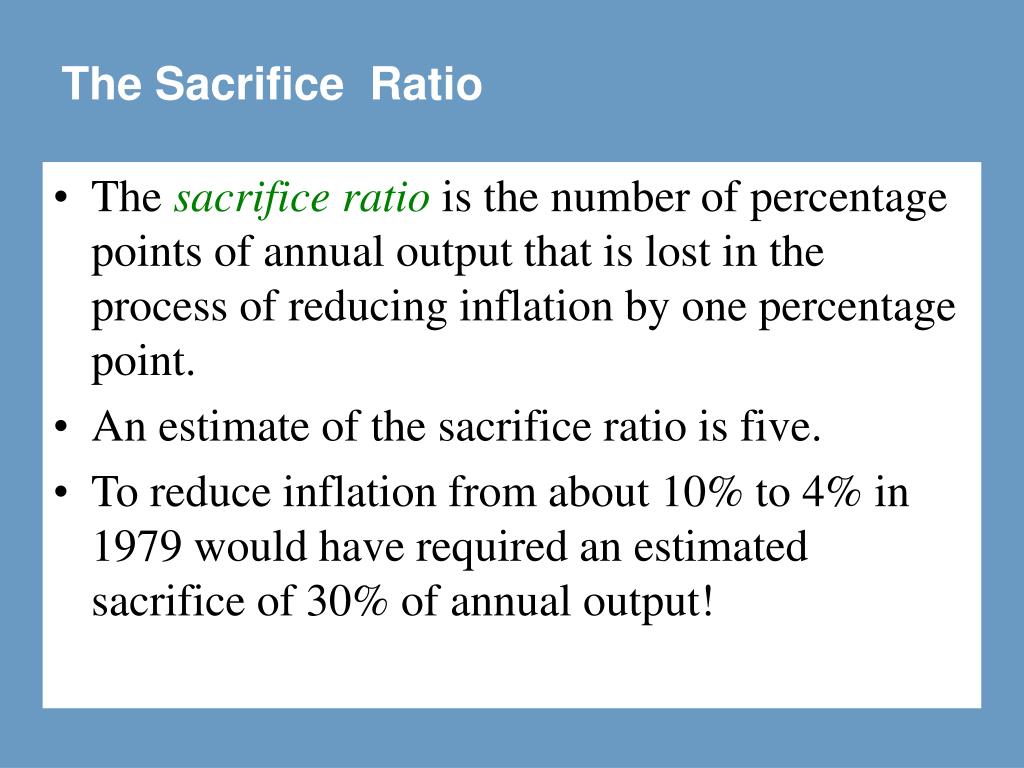

Sacrificing Ratio Meaning, Example, Formula, etc

It measures the cost of reducing inflation by a certain percentage, in terms of the increase in unemployment required. For example, if a country wants to reduce inflation by 1%, the sacrifice ratio would indicate the percentage increase in unemployment necessary to achieve that goal. It is important to note that the optimal sacrifice ratio can vary across different economies.

How to Calculate Sacrificing Ratio

It is the ratio of cumulative percentage loss of GDP (due to disinflationary policy) to the reduction in inflation that is actually achieved. A – The sacrifice ratio assists the policymakers track the past monetary fluctuations and design a better fiscal policy accordingly. As needed, they can implement the steps required for boosting or reducing the economic pace. The SR depicts the sacrifice in terms of unemployment that monetary authorities have to make to pull down inflation. This sacrifice has to be made in the short run to reduce inflation expectations in the long run.

What is Sacrificing Ratio?

Therefore, to reach the desired 2% inflation rate, unemployment would need to increase by 9 percentage points. As with most calculations used to measure the condition of the economy, the sacrifice ratio is only as good as the data collected. Okun’s Law estimates the relationship between output and unemployment, and the short-run Phillips curve estimates the relationship between inflation and unemployment. The surge or reduction in SR is related to inflation rate fluctuations and approach to labor and product markets. While countries with more adaptable labor agreements, self-reliant central banks, stable rates, and reliable economic regulations possess a lower SR.

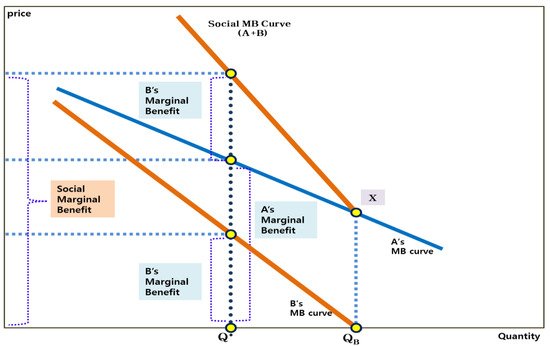

How to Beat Stagflation (with a case study)

After exploring the concept of sacrifice ratio and understanding the trade-off it presents between inflation and unemployment, it is crucial to determine the optimal sacrifice ratio for policymakers. This ratio holds significant importance as it directly affects the well-being of an economy and its citizens. In conclusion, the traditional trade-off between inflation and unemployment as depicted by the Phillips Curve is not the only lens through which policymakers can approach macroeconomic management. Alternative approaches, such as supply-side economics, wage flexibility, and unconventional monetary policies, offer different strategies for achieving a balance between these two variables. By considering these alternative approaches, policymakers can potentially find innovative solutions to the challenges of inflation and unemployment in today’s complex economic landscape.

- In the event that an economy is facing inflation, central banks have tools they can use to slow economic growth in a bid to reduce inflationary tensions.

- Since the ratio depicts the annual output an economy forgoes to reduce inflation, a low SR is always desirable.

- Monetary policy decisions made by central banks have a direct impact on the sacrifice ratio.

- According to this theory, allowing wages to adjust more freely in response to changes in supply and demand conditions can help maintain equilibrium in the labor market.

- When an individual enters the firm as a firm partner, it becomes mandatory to adopt a new profit sharing ratio.

The Relationship Between Inflation and Unemployment

On the other hand, the partner who gains the share calculates a gaining ratio at his/her end. While the sacrifice ratio is a widely used economic concept to understand the trade-off between inflation and unemployment, it is not without its critics and limitations. In this section, we will explore some of the main criticisms and limitations of the sacrifice ratio.

It seems that the economy may be facing a catastrophic recession of a magnitude not seen since the Great Depression of the 1930s may be on the horizon. Next, Using Okun’s law, we can estimate how much output will fall given a one percentage point increase in unemployment. The movement from point A to B depicts the sacrifice to be made to reduce inflation. When inflation expectations reduce in the long run, the Phillips curve PC2 is formed.

The sacrifice ratio shows how much output is lost when inflation goes down by 1%. This helps central banks to set their monetary policies, contingent upon whether they need to support or dial back the economy. For instance, if inflation is getting too high, the central bank can utilize the sacrifice ratio to determine what moves to make and at what level to influence output in the economy basically cost. The sacrifice ratio shows how much output is lost when inflation goes down by 1%.

During this period, the country faced high levels of inflation, reaching double digits. In an attempt to combat inflation, the Federal Reserve implemented contractionary monetary policies, resulting in a significant increase in unemployment. This experience highlighted the challenges policymakers face when trying to strike a balance between inflation and unemployment. sacrifice ratio formula An analysis of the ratio would show how the country might respond if the level of inflation changes by 1%. For example, if aggregate demand expands faster than aggregate supply in an economy, the result is higher inflation. If an economy is facing inflation, central banks have tools they can use to slow economic growth in a bid to reduce inflationary pressures.

One notable example of the sacrifice ratio in action is the Volcker disinflation in the United States during the early 1980s. To combat high inflation, then-Federal Reserve Chairman Paul Volcker implemented tight monetary policies, resulting in a significant increase in interest rates. This move led to a short-term rise in unemployment, but it successfully reduced inflation in the long run.

Credit Balance Meaning, Explanation, Examples, Accounts

Content

- Credit Balance Meaning

- What Are Some Examples of Debits & Credits?

- Accounting 101: Debits and Credits

- The five accounting elements

- The Cash account has a credit balance. Which statement is true? a. This is the normal balance for…

- Debit and credit examples

- How are accounts affected by debit and credit?

If you have a https://personal-accounting.org/ balance instead, that means your cash is currently in the red. All asset accounts such as Cash, Accounts Receivable, Inventory, Prepaid Expenses, Buildings and Equipment normally have debit balances.

What does it mean when a cash account has a credit balance?

If the total of your credits exceeds the amount you owe, your statement shows a credit balance. This is money the card issuer owes you. You can call your card issuer and arrange to have a check sent to you in the amount of the credit balance.

Seamlessly integrate with all intercompany systems and data sources. Automatically identify intercompany exceptions and underlying transactions causing out-of-balances with rules-based solutions to resolve discrepancies quickly. Make the most of your team’s time by automating accounts receivables tasks and using data to drive priority, action, and results. Monitor and analyze user performance, ensuring key actions quickly. Transform your order-to-cash cycle and speed up your cash application process by instantly matching and accurately applying customer payments to customer invoices in your ERP.

Credit Balance Meaning

Moreover, the examples encompass partnerships and LLCs, sole proprietorships, and shareholders. Ledger in AccountingLedger in accounting records and processes a firm’s financial data, taken from journal entries. This becomes an important financial record for future reference. While a long margin position has a debit balance, a margin account with only short positions will show a credit balance.

When can a cash account have a credit balance?

A negative cash balance results when the cash account in a company's general ledger has a credit balance. The credit or negative balance in the checking account is usually caused by a company writing checks for more than it has in its checking account.

As long as you ensure your debits and credits are equal, your books will be in balance. This will help ensure that all of your general ledger account balances are correct, and allow you to generate accurate financial statements that give you insight into your business finances. An accounting system tracks the financial activities of a specific asset, liability, equity, revenue or expense. You’ll record each individual account in a ledger and use this information to prepare your financial statements. Records increase and decrease as accounting transactions occur, and this movement represents the diametrical relationship between debits and credits. Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts.

What Are Some Examples of Debits & Credits?

A debit means what is due or owed—it refers to money going out. Credit means to entrust or loan—it refers to money coming in. Whether you’re creating a business budget or tracking your accounts receivable turnover, you need to use debits and credits properly. Intraday Buying Power – This balance field applies only to Pattern Day Trade accounts and Limited Margin accounts and is the amount that can be used to buy stock or options intended to be day traded. Unlike Day Trade Buying Power, this value does update intraday to reflect day trade executions, money movement into and out of the account, core cash, and buying power allocated to open orders.

- Any transaction the includes the payment or disbursement of cash is recorded on the credit side of the cash account.

- But it’s an integral business activity that helps you generate invoices, pay your employees and bills and understand your business’s overall health.

- The credit side of the entry is to the owners’ equity account.

- We can illustrate each account type and its corresponding debit and credit effects in the form of anexpanded accounting equation.

- So do most expense accounts such as Interest, Wages and Rent.

- Again, according to the chart below, when we want to decrease an asset account balance, we use a credit, which is why this transaction shows a credit of $250.

Recording a sales transaction is more detailed than many other journal entries because you need to track cost of goods sold as well as any sales tax charged to your customer. As a business owner, you may find yourself struggling with when to use a debit and credit in accounting. Once you complete the online enrollment process, Limited Margin is immediately available on your account. The Cash/Margin trade type drop down will appear on the trade ticket and default to Margin for orders placed in your IRA.

Accounting 101: Debits and Credits

Liability accounts record debts or future obligations a business or entity owes to others. When one institution borrows from another for a period of time, the ledger of the borrowing institution categorises the argument under liability accounts.

PenFed Platinum Rewards Visa Signature Card: Earn Top Rewards … – CNET

PenFed Platinum Rewards Visa Signature Card: Earn Top Rewards ….

Posted: Sun, 19 Feb 2023 00:00:02 GMT [source]

The Why Would a Cash Account Have a Credit Balance? of using debits and credits creates a ledger format that resembles the letter “T”. The term “T-account” is accounting jargon for a “ledger account” and is often used when discussing bookkeeping.

What Is the FIFO Method? A Complete Guide to First-In, First-Out Inventory

To better understand the FIFO inventory method, imagine a gumball machine. The gumballs at the bottom of the machine were likely the first ones added. When you insert a coin and Certified Public Accountant turn the knob, those gumballs at the bottom, which went in first, will be the ones that come out first.

Reduces inventory costs, waste, and spoilage

This reduces the risk of having to dispose of outdated products and minimizes inventory spoilage. This is essential for businesses that sell products with expiration dates, such as food and beverages. By selling the oldest items first, businesses can ensure that their customers are receiving fresh and usable products.

- It is simple—the products or assets that were produced or acquired first are sold or used first.

- In the FIFO Method, the value of ending inventory is based on the cost of the most recent purchases.

- This has resulted in a lower inventory cost and a higher profit margin for your business.

- Specific inventory tracing is an inventory valuation method that tracks the value of every individual piece of inventory.

What is FIFO? First In, First Out Method Explained

Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

- The other 10 units that are sold have a cost of $15 each and the remaining 90 units in inventory are valued at $15 each or the most recent price paid.

- LIFO, or Last In, First Out, is an inventory value method that assumes that the goods bought most recently are the first to be sold.

- No, because there are other inventory cost flow assumptions that might be a better fit for some businesses.

- Seamless integration between inventory management and accounting systems ensures FIFO calculations are correctly reflected in financial reports.

- By ensuring that the first inventory sold comes from the oldest items in stock, businesses can avoid having to sell newer and more expensive items at the same price as older, cheaper items.

- It’s also the most accurate method of aligning the expected cost flow with the actual flow of goods.

Single Item Picking

The First In, First Out FIFO method is a standard accounting practice that assumes that assets are sold in the same order they’re bought. All companies are required to use the FIFO method to account for inventory in some jurisdictions but FIFO is a popular standard due to its ease and transparency even where it isn’t mandated. Every time a sale or purchase occurs, they are recorded in their respective ledger accounts. However, as we shall see in following sections, inventory is accounted for separately from purchases and sales through a single adjustment at the year end.

By ensuring that the oldest products are sold first, FIFO allows businesses to make quick adjustments to their inventory levels in order to meet customer demand. However, FIFO can be used in any industry where product demand or prices may fluctuate. By ensuring that the older inventory is sold first, FIFO helps to avoid having too many products sitting in inventory that could eventually become obsolete or decrease in value. There are also other benefits of using FIFO which we’ll discuss in this article. Eric is an accounting and bookkeeping expert for Fit how to calculate fifo Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University.

- The FIFO method can also be used to help businesses accurately calculate their income taxes.

- While FIFO refers to first in, first out, LIFO stands for last in, first out.

- The use of FIFO method is very common to compute cost of goods sold and the ending balance of inventory under both perpetual and periodic inventory systems.

- FIFO assumes that assets with the oldest costs are included in the income statement’s Cost of Goods Sold (COGS).

- Here’s a summary of the purchases and sales from the first example, which we will use to calculate the ending inventory value using the FIFO periodic system.

Do you have a choice when it comes to using the FIFO inventory valuation method?

Spreadsheets and accounting software are limited in functionality and result in wasted administrative time when tracking and managing your inventory costs. Often compared, FIFO and LIFO (last in, first out) are inventory accounting methods that work in opposite ways. Where the FIFO method assumes that goods coming through the business first are sold first, LIFO assumes that newer goods are sold before older goods. In inventory management, FIFO helps to reduce the risk of carrying expired or otherwise unsellable stock. In accounting, it can be used to calculate your cost of goods sold (COGS) and tax obligations.

Average Cost Method of Inventory Valuation

- But it requires tracking every cost that goes into each individual piece of inventory.

- LIFO (“Last-In, First-Out”) means that the cost of a company’s most recent inventory is used instead.

- Theoretically, the cost of inventory sold could be determined in two ways.

- You can use our online FIFO calculator and play with the number of products you sold to determine your COGS.

- The problem with this method is the need to measure value of sales every time a sale takes place (e.g. using FIFO, LIFO or AVCO methods).

- Being fluent with your financial statements allows you to see where your money is going, where it’s coming from and how much you have to work with.

- FIFO is an inventory valuation method that stands for First In, First Out, where goods acquired or produced first are assumed to be sold first.

Yes, FIFO is still a common inventory accounting method for many businesses. It’s required for certain jurisdictions, while others have the option to use FIFO or LIFO. This method dictates that the last item purchased or acquired is the first item out.

FIFO assumes that assets with the oldest costs are included in the income statement’s Cost of Goods Sold (COGS). The remaining inventory assets are matched to assets that were most recently purchased or produced. FIFO means “First In, First Out.” It’s an asset management and valuation method in which older inventory is moved out before https://www.bookstime.com/ new inventory comes in. The average cost method is the simplest as it assigns the same cost to each item. The average cost is found by dividing the total cost of inventory by the total count of inventory. Under the moving average method, COGS and ending inventory value are calculated using the average inventory value per unit, taking all unit amounts and their prices into account.

Key Accounting Considerations for Consumer Packaged Goods CPG Companies CFOx

If you don’t manage your inventory properly, it can lead to inaccurate financial data. For instance, you are overstocked one month, and you are in low inventory the next. Ongoing advances in digital marketing, data analytics, and supply chain efficiency will likely shape the next era of innovation for CPG companies. Faced with shifting consumer preferences, brands must continue adapting to the times to stay competitive.

- For instance, Dollar Shave Club upended razors through viral marketing and subscription models.

- During periodic controversies like food recalls or misleading claims, sincere brand outreach prevents isolated incidents from permanently sinking reputation.

- Consumer packaged goods are sometimes known as fast-moving consumer goods (FMCGs) because they sell quickly and are consumed quickly.

- The name originates in their packaging, which traditionally is easily recognizable wrapping that consumers can quickly identify on store shelves.

- Below are profit margins for the eight largest CPGs in the S&P 100 as of March 2020.

Devise a technology-enabled ESG strategy to help create value for all stakeholders

- A good partner can help optimize inventory levels, manage accounts receivable and accounts payable, and also assist with cash flow forecasting for your CPG.

- At CJBS we partner with you to determine best practices for your business.

- Any productivity program needs to pair automation efforts with the classic levers of demand management, spans and layers, and low-cost locations.

- CPG brands also give retail partners greater decision authority over inventory quantities and placement to optimize based on local buying patterns and store format constraints.

- And representing 30% of total US retail sales, CPG brands are the lifeblood of grocers, pharmacies, convenience stores, and other retailers nationwide.

- Now, CPGs need to embrace the potential of digital and generative AI (gen AI) to open up fundamental new levels of cost reduction while rightsizing costs to serve in lower-potential markets.

Several crops are in an acute position, in which they face both substantially increasing drought risk and highly concentrated footprints, including almonds, olives, hops, and cocoa. These changes in climate are expected to increase volatility in supply and price, necessitating cpg accounting shifts in where crops are grown and the need for further climate-resilient growing practices. Before the pandemic, large brands’ loss of market share was a big story. From 2016–19, US small brands (those with less than $150 million in revenue) generated 50 percent of value growth despite representing only 11 percent of 2016 revenues, mostly at premium price points. Now, the cost-of-living crisis has caused 80 percent of consumers to pull back on spend, and the rise in interest rates has led many privately funded small brands to reduce their marketing budgets. Trade spend involves managing relationships of investments with retailers.

Easy Actions to Simplify Your Revenue Growth

If you’re looking for support with your company’s chargeback management then grab some time on our calendar to start the conversation. As you get more retail partners for your brand, managing trade spend becomes more critical in your daily operations. You’ll have multiple partners — each with their own promotions, spend calendars, order volumes, and deductions. Customer lifetime value measures the strength of the relationship between a brand and a consumer. The stronger the relationship, the higher the lifetime sales and the lower the attrition or churn.

- To do so requires a change in strategy from compiling brand and consumer segment insights to compiling privileged individual consumer insights that provide true differentiation.

- They are also partnering with predictive analytics firms to gauge a consumer’s lifetime value even before that consumer buys a product from the company.

- Examples are food, beverages, personal care items, and cleaning supplies.

- Tide cleaned up with the first heavy duty laundry detergent fortifying it against minerals in hard water.

- Next-generation consumer engagement also allows brands to personalize products, as L’Oréal has demonstrated.

- Changing consumer preferences and behaviors, accelerated by the pandemic, continue to render current operating models obsolete in an omnichannel consumer environment.

- Most CPGs need to relook at their capabilities on each of these topics and determine what they need to do differently to consistently win the battle for market share, and propel market expansion.

Next in consumer packaged goods

Real-time data exchange with partners increases inventory visibility enabling quicker reactions. Centralized distribution centers equipped with automated pick and pack systems help brands scale. Seasonal items require temporary outlet expansion and storage flexibility while exclusive products for wholesalers necessitate tailored inventory allocation. Consumer packaged goods (CPG) play a pivotal yet often overlooked role in our daily lives.

CPG companies also cater to the specific needs of children from infancy assets = liabilities + equity into their early years. Diapers, baby food and formula, wipes, and baby toiletries make up one subcategory. Child safety products like cabinet locks or safety gates enable parents to babyproof homes. Essential for household maintenance, and home care CPG products include surface cleaners, laundry detergents, disinfectants, paper goods, and more niche offerings like beard oil and shoe polish. Ingredients and scent profiles aim to convey efficacy claims and appeal to consumer preferences. As the consciousness of ingredients and ethics rises, brands respond with natural formulas and cruelty-free positioning.

Best Cloud Accounting Software Of 2024

These options were also always available to me wherever I was in the platform via a slide-out left-hand menu. I simply had to input my email, name and phone number into a simple sign-up form. Once I finalized the invoice, I could click the “send to” button at the top of the invoice and input an email address, a subject and a message to send the invoice.

Third-party Reviews

- From there, I was asked a few questions about my business, such as the types of services I offer and how big my team is.

- Zoho Books is the cloud-based accounting component of a larger suite of business solution tools.

- Cloud accounting software should include native time tracking capabilities as well as integration with popular time tracking services like Clockify and Harvest.

When I clicked on it, I was presented with a simple form to toggle on and off the widgets I wanted on the dashboard. By clicking “edit dashboard,” you can only remove a couple of reports but cannot add any new ones. Zoho Books is a good choice for small businesses that are already using Zoho products and services because it integrates well with other Zoho apps. It’s also a good fit for service-based businesses, such as consultants, landscapers and plumbers. Easy to use, well-designed, and deep, Quickbooks Online will equip you with the most effective accounting tools while being uninhibited by internet speed and cost effectiveness.

It offers two distinct operational modes—“Do-It-For-Me” and “I-Do-It-Myself”—allowing businesses to choose the level of control they wish to exert. This adaptability ensures businesses can navigate growth phases while maintaining financial oversight. Notably, OneUp is replete with features such as dashboards, invoicing, CRM and starting a small business more, offering businesses an expansive toolkit to navigate their financial landscape. The platform’s commitment to consistency across devices ensures that as businesses grow, their accounting access remains unhindered, whether they’re at the office desk or on the move.

Cloud Accounting Software vs Traditional Accounting

In QuickBooks Online, you can reorder products by automatically creating purchase orders and automate all parts of the sales cycle. Also, you want to be sure that the app works within your platform, as some or compatible only with iOS devices, and others can be transmitted to smartwatches as well. Wave, for example, allows you to maintain more than one business individually under a single account. Before searching for intricate features, you need to determine how and where you want to use the software and take everyone else who will be using the system into consideration. To acquire the license pricing, you will need to contact NetSuite’s team. The software will always keep you in line with the latest tax rules, ranging from compliance requirements to EU-VAT complications, along with encrypting all your activity with PCI accounting cycle definition Level 1 certification.

Access Your Finances Anytime from Anywhere

In addition to its base plan, Neat offers add-on features ranging from $50 to $150 per year, including enhanced customer support and automations. Here is an overview of the pricing and features available in each add-on. Users say the platform is highly customizable while still being an out-of-the-box solution. They also say that because the accounting software connects to other business solutions, it is a seamless solution social roles and social norms across their companies. However, they say that using customizations requires a learning curve, and the price increases at each renewal, rendering the platform unaffordable for many small businesses in time. Along the top of the interface is a menu with options such as “business,” “accounting,” “projects” and “contacts.” When you click a menu option, you are given a list of options.

While upgrading traditional accounting software is expensive, difficult, and time-consuming, cloud accounting software requires nothing you need to install or update. Freshbooks is a tool that allows you to give your accountant the permissions to access your dashboard, invoices, expenses, reports, and accounting. While some software offer remote accessibility with their mobile app, others provide separate apps for employees and equip them with time-tracking, expense receipt-submitting, and other functionalities.

Companies that want to link payroll to their accounting software must integrate with Gusto at $40 per month. You can import data from another accounting system in bulk via CSV files once you’ve done the initial set up in Xero. That includes the chart of accounts, invoices, bills, contacts and fixed assets. For a smooth transition and best results, we recommend working with an accountant or bookkeeper, preferably one with Xero experience, when you make the move to Xero cloud accounting software. With a cloud-based software program, you can access your financial data anytime, anywhere. You don’t need to worry about wasting time with downloads and updates that come with regular software because the cloud is hosted remotely.

Why You Can Trust Forbes Advisor Small Business

Improves efficiency by automating traditional accounting tasks such as automatically updating financial information and providing real-time financial reporting. QuickBooks integrates with a wide range of apps including eCommerce, inventory, expense management, and CRM apps to streamline your business and sync your data. Connect with apps you already use to power your business like Shopify, eBay, OpenCart, Synder, and more. Invite your accountant, bookkeeper, or employees to work in the cloud so your team is on the same digital page. With a few clicks, you can create secure access privileges and change user access at any time.

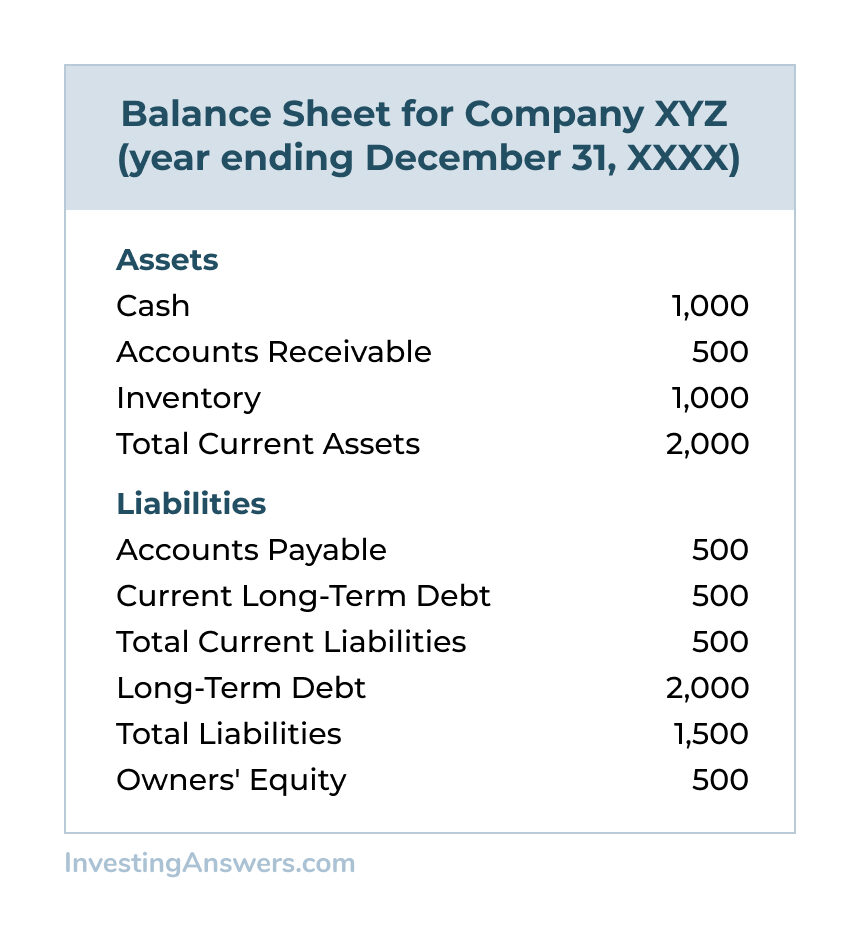

Current Ratio Meaning, Interpretation, Formula, Vs Quick Ratio

This formula provides a straightforward way to gauge a company’s liquidity and its ability to meet short-term financial obligations. But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns. The current ratio provides the most information when it is used to compare companies of similar sizes within the same industry. Since assets and liabilities change over time, it is also helpful to calculate a company’s current ratio from year to year to analyze whether it shows a positive or negative trend. If a company’s current ratio is less than one, it may have more bills to pay than easily accessible resources to pay those bills. The current liabilities of Company A and Company B are also very different.

Liquidity Analysis – Why Is the Current Ratio Important to Investors and Stakeholders?

Companies in heavily regulated industries may need to maintain higher current assets to meet regulatory requirements. Companies may need to maintain higher current assets the 2023 surest guide for organizing an office filing system in a highly competitive industry to meet their short-term obligations in a downturn. The current ratio can provide insight into a company’s operational efficiency.

Current Ratio Vs Quick Ratio

Company A has more accounts payable, while Company B has a greater amount in short-term notes payable. This would be worth more investigation because it is likely that the accounts payable will have to be paid before the entire balance of the notes-payable account. Company A also has fewer wages payable, which is the liability most likely to be paid in the short term.

Company

For example, a company may have a good current ratio but difficulty remaining competitive long-term without investing in research and development. A company may have a good current ratio compared to other companies in its industry, even if it is below the general benchmark of 1. Ignoring industry benchmarks can lead to incorrect conclusions about a company’s financial health. Another way to improve a company’s current ratio is to decrease its current liabilities. This can be achieved by paying off short-term debts, negotiating longer payment terms with suppliers, or reducing the amount of outstanding accounts payable. The regulatory environment in the industry can affect a company’s current ratio.

Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company. This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. So, a ratio of 2.65 means that Sample Limited has more than enough cash to meet its immediate obligations.

Focusing Only On Short-Term Financial Health – Mistakes Companies Make When Analyzing Their Current Ratio

We hope this guide has helped demystify the current ratio and its importance and provided useful insights for your financial analysis and decision-making. Inventory management issues can also lead to a decrease in the current ratio. If the company holds too much inventory that is not selling, it can tie up cash and reduce the current ratio. Larger companies may have a lower current ratio due to economies of scale and their ability to negotiate better payment terms with suppliers. Creditors and lenders often use the current ratio to assess a company’s creditworthiness.

We have discussed a lot about the advantages and benefits of having an optimum current ratio. However, there are a few factors from the other end of the spectrum that prove to be a disadvantage. These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds. If a company has a current ratio of 100% or above, this means that it has positive working capital. Hence, Company Y’s ability to meet its current obligations can in no way be considered worse than X’s. As a general rule of thumb, a current ratio in the range of 1.5 to 3.0 is considered healthy.

- You can calculate the current ratio by dividing a company’s total current assets by its total current liabilities.

- These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds.

- This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry.

- But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns.

- In the above example, XYZ Company has current assets 2.32 times larger than current liabilities.

- Read about features, pricing, and more to make the best decision for your company.

If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default. Increased current liabilities, such as accounts payable and short-term loans, can also lower the current ratio. This can happen if the company takes on more debt to fund its operations or is experiencing delays in paying its suppliers. The current ratio does not provide information about a company’s cash flow, which is critical for assessing its ability to pay its debts as they become due.

Other measures of liquidity and solvency that are similar to the current ratio might be more useful, depending on the situation. For instance, while the current ratio takes into account all of a company’s current assets and liabilities, it doesn’t account for customer and supplier credit terms, or operating cash flows. One of the simplest ways to improve a company’s current ratio is to increase its current assets. This can be achieved by increasing cash reserves, accelerating accounts receivable collections, or reducing inventory levels. By increasing its current assets, a company can improve its ability to meet short-term obligations.

With both values in hand, one can proceed to calculate the current ratio by dividing the total current assets by the total current liabilities. Both of these indicators are applied to measure the company’s liquidity, but they use different formulas. It measures a company’s ability to cover its short-term obligations (liabilities that are due within a year) with current assets. To assess this ability, the current ratio compares the current total assets of a company to its current total liabilities. In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand.

It helps investors, creditors, and management assess whether a company can comfortably navigate its short-term financial waters or if it’s sailing into rough financial seas. It’s a key indicator in the world of finance that’s worth keeping an eye on to make informed decisions about a company’s financial stability. Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room. A current ratio lower than the industry average could mean the company is at risk for default, and in general, is a riskier investment. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition.

Demystifying Encumbrance Accounting: Definition And Recording

An encumbrance, also called a pre-expenditure, is a method of tracking future period payments prior to the finalization of the project or the receipt of goods. Think of encumbrances as reserved funds to later pay pre-determined liabilities that will occur later. There are different encumbrance types, ranging from reserves for payroll to money set aside by budgetary control groups for things like contingency expenses. Encumbrance journal entries and accounting are also sometimes called commitment accounting. This naming makes more sense when you realize that encumbrance enables budgetary control by recording money that is allocated for future projects, preventing over-expenditure of a budget. There are various software options available that can streamline the process and improve accuracy.

An Introduction to Encumbrance Accounting & The Encumbrance Process

Money from the encumbrance account is moved into the appropriate account to pay the invoice, and accounts payable handles the vendor payment. Manual encumbrance lines are made on the general ledger, most commonly after a purchase requisition process. Once a purchase order (PO) goes through the approval process, the encumbrance transaction then shows the money appropriations for that purchase. Any unpaid encumbrances at the end of the year processing, such as outstanding purchase orders, are examined and may carry to the first period of the following year. An encumbrance balance refers to restricted funds that have been set aside for known future expenses of a company. While appropriations are money set aside for budgetary line items, encumbrances are reserves for a specific Accounting For Architects item.

Monitoring and Analyzing Encumbrances

As a result, they’re able to avoid exceeding the allocated budgets and minimize overspending. This method of accounting helps institutions set better budgets and control overspending and maverick spending. Similarly, the public sector faces challenges in implementing encumbrance accounting due to its unique funding sources and objectives. Public sector organizations, such as government agencies and educational institutions, often rely on grants and subsidies, which introduce additional complexities in encumbrance tracking. Budgetary constraints, changing priorities, and the need for transparency and accountability further complicate the encumbrance accounting process in the public sector. It is important to note that the process of monitoring and analyzing encumbrances may vary depending on the sector.

- An encumbrance refers to a budgetary reservation or a commitment of funds made by an organization to set aside a portion of its budget for future financial transactions or obligations.

- Various governments have adopted encumbrance accounting, nonprofits and some companies to handle sensitive finances better.

- Encumbrance data enables budgetary control, letting your company better understand where they are financially at any given time.

- This transparency promotes accountability, as leaders are held fully responsible for managing resources efficiently.

- With encumbrance accounting, future payment obligations are recorded in financial documents as projected expenses.

Encumbrance Accounting Journal Entries

One of the most common examples of an encumbrance is the money allotted when you create a purchase order for services or items from a vendor. When you make the PO, you then will generate an entry indicating the encumbrance or the money you will pay in the future for that order. Once you pay that supplier’s invoice, you will remove that money from within the encumbrance balance.

Encumbrances are typically used by businesses, government agencies, and nonprofit organizations to ensure responsible financial management. They serve as a proactive measure to earmark funds for anticipated expenses, bookkeeping and payroll services helping organizations plan and allocate resources effectively. This encourages transparency and increased visibility in how the budget is being allocated and how money is being spent. As a result, organizations can track their expenditures against the allocated budget more effectively.

- These software solutions eliminate the need for manual tracking and calculation of encumbrances, reducing the risk of errors and enhancing efficiency.

- This allows for better visibility and control over expenditures, as well as the prevention of fraud.

- By recording and adjusting encumbrances, organizations can effectively manage their budgets, track actual expenses, and ensure financial accountability.

- Non-profit organizations must balance the need for financial transparency with donor expectations and reporting requirements.

As companies strive for greater efficiency and transparency in their financial operations, encumbrance accounting proves to be an essential component of successful financial management. When tracking your transactions and expenses, it is crucial to reflect your cash flow on your general ledger accurately. Vital analysis, reports, and audits are based on the cash outflow and journal entries tracked by accounting, making accurate tracking much more than a simple general planning tool. Encumbrance accounting is a vital tool for organizations seeking to achieve accurate financial reporting, efficient budget control, and informed decision-making. By utilizing encumbrance accounting methods, companies can track future payments and expenses, gaining a detailed view of their cash flow. This allows for better visibility and control over expenditures, as well as the prevention of fraud.

Use PLANERGY to manage purchasing and accounts payable

The company has set aside this amount, but hasn’t been paid yet as the goods or services haven’t been supplied. Accruals are transactions between a company and its vendors or suppliers that have been recorded but not yet paid or received. Government agencies must navigate complex procurement processes and comply with various accounting regulations.

Accounts Payable AP Outsourcing in 2024: Pros, Cons, and Evaluation

Below are our top tips for three areas to consider when choosing the best AP outsourcing provider. These challenges can result in misunderstandings and delays in communication, which can adversely affect the accuracy and timeliness of services provided. Discover the pros, cons, and best providers of accounts payable outsourcing. Your AP service provider should be able to integrate their preferred software with your tech stack, including your accounting system, inventory management platform, and ERP.

Imagine a world where invoices are processed and payments are made in the blink of an eye. With outsourced accounts payable services, that world becomes a reality. Embrace the laughter-inducing joy of automation and let the experts handle the nitty-gritty details. Outsourcing accounts payable processes can offer a wide range of benefits to businesses, such as cost savings, improved efficiency, and enhanced visibility and control over financial transactions.

Also, some organizations may prefer to retain direct (manual) control over their accounts payable operations. Outsourcing accounts payable processes can lead to significant improvements in efficiency for businesses. Outsourcing your accounts payable processes can help streamline payments and save on labor, time, and errors.

What Can You Do With Time Doctor?

- With its extensive experience and a strong presence in the US, Accenture offers valuable support to businesses seeking to optimize their accounts payable processes.

- By outsourcing the tasks above, your organization can focus on more strategic activities and let the outsourcing provider handle the time-consuming and tedious aspects of AP functions.

- Companies outsource their accounts payable operations in part to gain access to better tools and processes.

- Join our community of finance, operations, and procurement experts and stay up to date on the latest purchasing & payments content.

- Vendor relations should be taken as a customer service approach, because vendors can (and will) pull contracts from your company if they find it difficult to work with your business.

Automation offers all these outcomes without sacrificing the security or visibility of your AP process. With the right partner in place, your organization can unlock the potential of accounts payable outsourcing and drive the success of your financial operations. When assessing the cost and value of outsourcing AP services, it’s important to consider not only the upfront costs but also the long-term benefits. Many accounts payable outsourcing companies work off-site but use modernized technology that can be tracked at every step.

When considering accounts payable outsourcing, it’s essential to understand the services provided by accounts payable outsourcing companies. They offer a range of technology, personnel, and value-added consulting services to help manage your accounts payable processes more efficiently. Some of the most frequently outsourced processes include invoice receipt and processing, vendor management, what is operating cash flow formula ocf formula and payment processing. Accounts payable automation refers to implementing software solutions designed to streamline and automate accounts payable processes within your organization. Businesses can reduce manual data entry, minimize errors, and improve overall efficiency by automating tasks such as invoice receipt, processing, and payment.

Use performance tools to make sure your accounts payable outsourcing team measures up

This means that they’ll have systems in place to handle both a PO-backed or non-PO process, discrepancy resolution, vendor management and sometimes administrative support. While mistakes are inevitable with any manual process, duplicate payments cost businesses money; a lot of money in fact. A company that outsources its accounts payable may grow dependent on a third-party firm. This dependence is risky, especially if the outsourcing partner suddenly faces bankruptcy or security breaches. Such incidences may put a company’s accounts payable processes at risk. Outsourced firms for accounts payable have automated tracking features that allow partner businesses to monitor every step of the accounting process as needed.

The comprehensive guide to accounts payable outsourcing

With all your financial data in a unified dashboard, you can quickly find any invoice, analyze monthly spend, and find opportunities to optimize cash flow. AP management software can also automatically match purchase orders, send approvals to the right manager, communicate with your electronic payment platforms, and update your inventory numbers. With the right tool, you can get most of the same benefits as you would by outsourcing AP—with the added bonus that you can keep the process under your control. The most common AP processes that are outsourced are purchase order or invoice matching (0r 3 way matching), invoice automation, discrepancy resolution, and AP administration. A business can opt for what it wants to outsource depending on the magnitude of work and budget involved.

Four benefits of outsourcing accounts payable

ILM is a Virginia-based provider of accounts payable services to commercial clients, government entities, and nonprofits. They utilize artificial intelligence and machine-learning algorithms in their smart-scanning and exception-handling technology, ensuring efficient and accurate invoice receipt and processing. The main advantage of in-house accounts payable departments is that businesses have control over processes and systems. In-house employees are more accessible, so questions and issues may be directed to the concerned parties right away. However, one main issue is whether companies can entrust their most essential financial processes and highly confidential data to a third-party firm. Accounts payable services also help you avoid costly errors and penalties.

But without the right efficiencies and reporting tools, the risk of payments fraud and vendor non-compliance escalates as businesses grow. In fact, according to the 2018 Payments Fraud and Control Survey by the Association for Financial Professionals (AFP), 78% of all organizations surveyed were hit by payments fraud in 2017. Among those that were hit by fraud, 92% said the attacks collectively cost at least 0.5% of their organization’s annual revenue. No matter your current accounting system, the best accounts payable outsourcing firms have the tools to integrate with it. If you’re fed up with your current system, a provider can even help you onboard a new one.Easy integration helps you get started quickly so you can see value immediately.

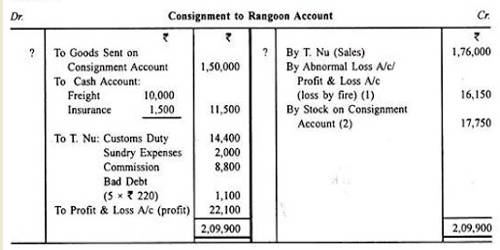

What is Consignment Inventory? The Ultimate Guide

People sell toys, furniture, shoes, and clothes on consignment frequently. Biggs Inc. manufactures healthy snacks, which are eventually passed on to specialty food shops on a consignment basis. For the month of December 2019, they transferred goods equivalent to $5,000 to the consignee. This requires transferring standard deduction the goods from the Finished Goods account to the Consignment Inventory account. The NET income of $2,450 represents the profit made by the consignor on this inventory consignment. The debit entry is made to the personal account of the consignor and represents the owed by the consignor to the consignee.

Is consignment inventory right for my business?

Moreover, the consignee also needs to record the commission income which depends on the term and condition. In order to solve this problem, Mr. A allows the seller to put the books on their shelve without paying until they are sold. Both parties may add the additional books to prevent any shortage during the next month. Consignment inventory is common in industries where companies transfer their goods to the dealer, which distribute or sell them further. The dealer, in this case, is only responsible for its distribution or retail operations. Like IAS 2, transport costs necessary to bring purchased inventory to its present location or condition form part of the cost of inventory.

Consignment Accounting: Definition & Format