Current Ratio Meaning, Interpretation, Formula, Vs Quick Ratio

This formula provides a straightforward way to gauge a company’s liquidity and its ability to meet short-term financial obligations. But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns. The current ratio provides the most information when it is used to compare companies of similar sizes within the same industry. Since assets and liabilities change over time, it is also helpful to calculate a company’s current ratio from year to year to analyze whether it shows a positive or negative trend. If a company’s current ratio is less than one, it may have more bills to pay than easily accessible resources to pay those bills. The current liabilities of Company A and Company B are also very different.

Liquidity Analysis – Why Is the Current Ratio Important to Investors and Stakeholders?

Companies in heavily regulated industries may need to maintain higher current assets to meet regulatory requirements. Companies may need to maintain higher current assets the 2023 surest guide for organizing an office filing system in a highly competitive industry to meet their short-term obligations in a downturn. The current ratio can provide insight into a company’s operational efficiency.

Current Ratio Vs Quick Ratio

Company A has more accounts payable, while Company B has a greater amount in short-term notes payable. This would be worth more investigation because it is likely that the accounts payable will have to be paid before the entire balance of the notes-payable account. Company A also has fewer wages payable, which is the liability most likely to be paid in the short term.

Company

For example, a company may have a good current ratio but difficulty remaining competitive long-term without investing in research and development. A company may have a good current ratio compared to other companies in its industry, even if it is below the general benchmark of 1. Ignoring industry benchmarks can lead to incorrect conclusions about a company’s financial health. Another way to improve a company’s current ratio is to decrease its current liabilities. This can be achieved by paying off short-term debts, negotiating longer payment terms with suppliers, or reducing the amount of outstanding accounts payable. The regulatory environment in the industry can affect a company’s current ratio.

Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company. This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. So, a ratio of 2.65 means that Sample Limited has more than enough cash to meet its immediate obligations.

Focusing Only On Short-Term Financial Health – Mistakes Companies Make When Analyzing Their Current Ratio

We hope this guide has helped demystify the current ratio and its importance and provided useful insights for your financial analysis and decision-making. Inventory management issues can also lead to a decrease in the current ratio. If the company holds too much inventory that is not selling, it can tie up cash and reduce the current ratio. Larger companies may have a lower current ratio due to economies of scale and their ability to negotiate better payment terms with suppliers. Creditors and lenders often use the current ratio to assess a company’s creditworthiness.

We have discussed a lot about the advantages and benefits of having an optimum current ratio. However, there are a few factors from the other end of the spectrum that prove to be a disadvantage. These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds. If a company has a current ratio of 100% or above, this means that it has positive working capital. Hence, Company Y’s ability to meet its current obligations can in no way be considered worse than X’s. As a general rule of thumb, a current ratio in the range of 1.5 to 3.0 is considered healthy.

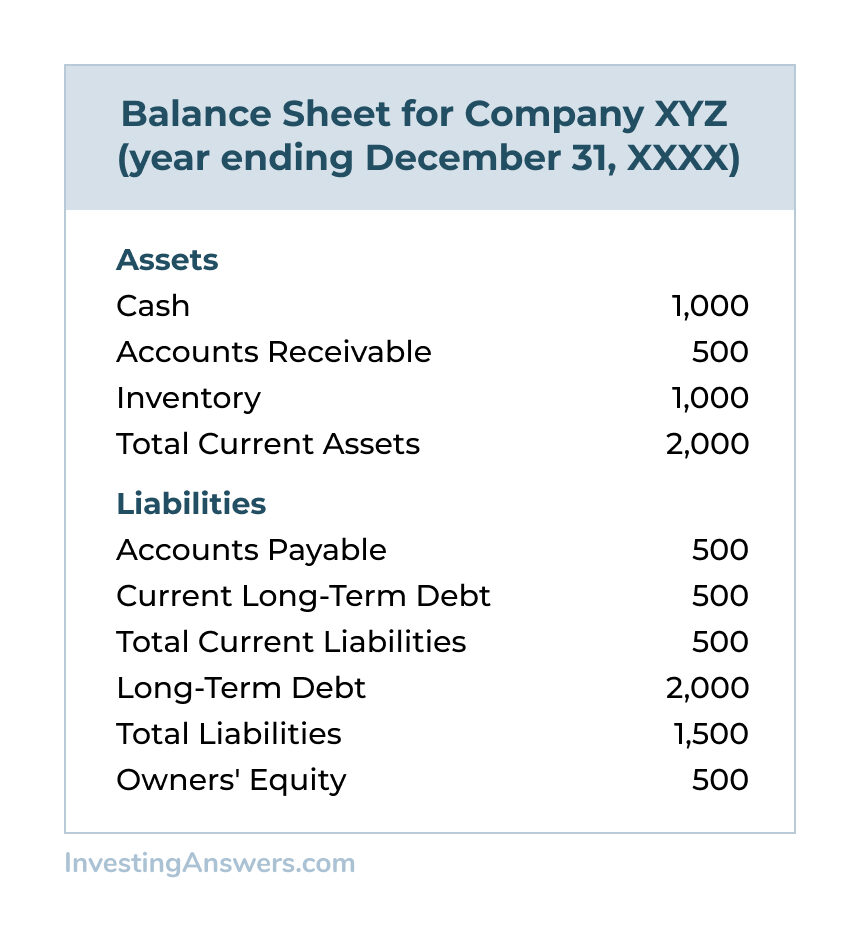

- You can calculate the current ratio by dividing a company’s total current assets by its total current liabilities.

- These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds.

- This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry.

- But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns.

- In the above example, XYZ Company has current assets 2.32 times larger than current liabilities.

- Read about features, pricing, and more to make the best decision for your company.

If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default. Increased current liabilities, such as accounts payable and short-term loans, can also lower the current ratio. This can happen if the company takes on more debt to fund its operations or is experiencing delays in paying its suppliers. The current ratio does not provide information about a company’s cash flow, which is critical for assessing its ability to pay its debts as they become due.

Other measures of liquidity and solvency that are similar to the current ratio might be more useful, depending on the situation. For instance, while the current ratio takes into account all of a company’s current assets and liabilities, it doesn’t account for customer and supplier credit terms, or operating cash flows. One of the simplest ways to improve a company’s current ratio is to increase its current assets. This can be achieved by increasing cash reserves, accelerating accounts receivable collections, or reducing inventory levels. By increasing its current assets, a company can improve its ability to meet short-term obligations.

With both values in hand, one can proceed to calculate the current ratio by dividing the total current assets by the total current liabilities. Both of these indicators are applied to measure the company’s liquidity, but they use different formulas. It measures a company’s ability to cover its short-term obligations (liabilities that are due within a year) with current assets. To assess this ability, the current ratio compares the current total assets of a company to its current total liabilities. In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand.

It helps investors, creditors, and management assess whether a company can comfortably navigate its short-term financial waters or if it’s sailing into rough financial seas. It’s a key indicator in the world of finance that’s worth keeping an eye on to make informed decisions about a company’s financial stability. Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room. A current ratio lower than the industry average could mean the company is at risk for default, and in general, is a riskier investment. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition.