What is Consignment Inventory? The Ultimate Guide

People sell toys, furniture, shoes, and clothes on consignment frequently. Biggs Inc. manufactures healthy snacks, which are eventually passed on to specialty food shops on a consignment basis. For the month of December 2019, they transferred goods equivalent to $5,000 to the consignee. This requires transferring standard deduction the goods from the Finished Goods account to the Consignment Inventory account. The NET income of $2,450 represents the profit made by the consignor on this inventory consignment. The debit entry is made to the personal account of the consignor and represents the owed by the consignor to the consignee.

Is consignment inventory right for my business?

Moreover, the consignee also needs to record the commission income which depends on the term and condition. In order to solve this problem, Mr. A allows the seller to put the books on their shelve without paying until they are sold. Both parties may add the additional books to prevent any shortage during the next month. Consignment inventory is common in industries where companies transfer their goods to the dealer, which distribute or sell them further. The dealer, in this case, is only responsible for its distribution or retail operations. Like IAS 2, transport costs necessary to bring purchased inventory to its present location or condition form part of the cost of inventory.

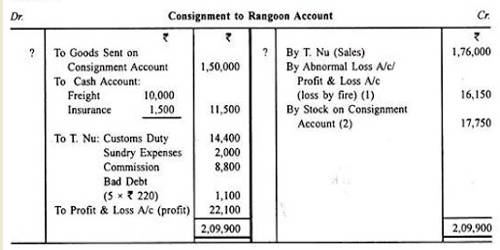

Consignment Accounting: Definition & Format

It may be a matter of developing your relationship and building your reputation over time. The consignor retains legal ownership of the inventory throughout the consignment period, even though the goods may be in the consignee’s possession for display or sale. Consigning inventory means transferring ownership of goods from one party (the consignor) to another (the consignee) for sale, display, or distribution. However, the consignor retains legal ownership of the inventory until it is sold to the end customer. Consigned inventory is typically not recorded as an asset on the consignee’s balance sheet until it is sold. Instead, it is often disclosed in the financial statements’ footnotes or the inventory disclosure section.

Consignment Inventory Benefits For Consignees in 2023

The treatment will differ according to whether the consignor has transferred the goods to a temporary consignment inventory account. Effective inventory management in consignment arrangements is a balancing act that requires both strategic planning and real-time monitoring. The consignor must maintain a clear record of the goods sent to the consignee, ensuring that these items are tracked separately from regular inventory.

Accounting Treatment:

- In fact, it’s virtually impossible to succeed in the long run without appropriately managing inventory.

- US GAAP allows the use of any of the three cost formulas referenced above.

- Accounting for consigned goods requires meticulous attention to detail to ensure that financial records accurately reflect the ownership and movement of inventory.

- Any item or piece of property that has been transferred from a consignor to a consignee with the intention of sale is considered to be consignment inventory.

- The consignee also keeps a percentage of the sale proceeds and pays the consignor a predetermined sales amount.

Are you an entrepreneur seeking innovative inventory management strategies to optimize your business operations? Dive into the world of consignment inventory—a powerful yet often misunderstood method that can revolutionize your supply chain and enhance your bottom line. This agreement specifies that one party will hold another party’s inventory for a specific purpose.

Think back to elementary school when you learned about a bee’s relationship with a flower. Bees collect nectar to feed their colonies while simultaneously spreading pollen from flower to flower. The goods must be returned to the consignor if they sell after the deadline. The percentage of sales that would go to the consignee and consignor is described in this section. In addition, this contract section frequently specifies when the consigner will receive the money.

It offers retailers protection against the risk of investing in items with uncertain customer demand, as they do not incur losses on unsold inventory. Simultaneously, it provides suppliers with greater control over the sales channels, pricing, and alignment with their brand identity. This is necessary for merchants to track consigned items independently from non-consigned items.

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. The consignee may continue to sell these goods even if new stocks have arrived. However, for perishable goods, the consignor may pull out old stock and replace it with new stock.

When you hear “consignment inventory,” your mind may wander to the olden days when your mom would drag you up and down the aisles of Goodwill or Salvation Army after school. Vendor managed inventory (VMI) and consignment inventory are often conflated, however, this is a common misconception. Here are answers to frequently asked questions related to consigned inventory.

Instead, they maintain a memorandum account to track the quantity and value of the consigned goods. This account helps the consignee manage the inventory without affecting their financial position. When a sale occurs, the consignee records the revenue and the cost of goods sold, while the consignor recognizes the sale and removes the corresponding inventory from their balance sheet.